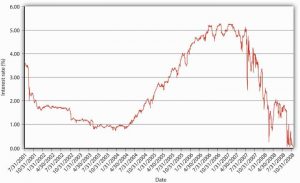

If you are a business owner, interest rates will likely increase in the coming years. Now is a good time to evaluate whether to incur new debt or find cost-cutting strategies.

Business loans offer companies looking for debt refinancing, working capital or growth financing an effective solution. Many lenders provide different types of business loans from one year to five years with relatively easy application procedures and quick approval processes – however it is essential that applicants understand how interest rates work before applying.

Business loans can be obtained from traditional banks, online lenders and peer-to-peer lending sites. Each has different eligibility requirements but in general a minimum credit score requirement of around 640 should suffice for approval. Lenders will also require access to both your personal and business credit reports as well as detailed financial data from you before issuing any loan.

Your choice of business loan will have an effect on the interest you pay over its lifespan. A term loan, in which you receive one lump sum and repay it over an established timeframe, is one popular form. Other business loan types include invoice financing (or invoice factoring), which involves selling unpaid invoices to third-party buyers in exchange for fees; equipment loans which provide businesses with specific pieces of equipment needed to operate; real estate business loans to help purchase commercial property and merchant cash advance loans which provide access to funds against future credit card sales by giving companies access to pools of funds in return for a percentage of future credit card sales from merchant cash advance lenders.

As a general rule, the lower your credit score and smaller the loan amount are, the higher the interest rate will be. There may be lenders offering specialty loans tailored specifically towards applicants with poorer credit; however, these typically incur an extra cost. To minimize costs associated with business loans, maintain good personal and business credit profiles by only borrowing when necessary.

Interest rate fluctuations often discourage business owners from taking on additional debt. Although their debt coverage ratios remain healthy, any monthly interest payments that fall outside their revenue stream can significantly diminish their bottom lines. An effective strategy would be to wait until rates become more affordable or implement cost cutting measures to increase profit margins and improve profit margins. If new borrowing is necessary, make sure it will help expand and grow your business and increase revenues. Other options could be more advantageous, such as deferring investments and saving up for purchases. A business loan calculator can also be helpful to get an estimate of how much borrowing will cost; many lenders provide their own calculators that allow comparison. Furthermore, these tools will give an idea of what your monthly repayments might look like over time.