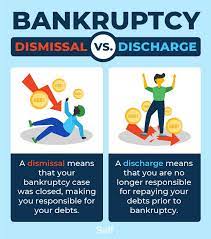

If you have student loan debt, bankruptcy might sound like an unlikely solution. That’s because student loans can be more challenging to discharge in bankruptcy than other forms of consumer debt, like credit card bills; showing undue hardship requires more evidence in court, so few borrowers ever actually see their loans discharged.

Congress made student loan discharge more challenging in bankruptcy in the 1970s. Legislators mandated that borrowers wait at least five years after beginning repayment before filing bankruptcy (later extended to lifetime borrowers in 1998). To get student loans discharged through bankruptcy proceedings, an adversary proceeding (essentially a separate lawsuit within bankruptcy cases) must take place, often at great expense – filing fees and attorney’s fees alone could cost thousands; even after getting your loans discharged you still owe back your loans owed back!

Experts argue that student loan discharge can be more costly and complicated than discharging other forms of consumer debt due to all the additional hoops borrowers must go through to discharge them. One reason may be that bankruptcy requires more income to make it through than simply paying their debt off directly – meaning most borrowers in dire financial straits who attempt to discharge student debt have little left over after paying all other bills.

Student loan debt can be challenging to discharge in bankruptcy because its burden affects borrowers differently from other forms of consumer debt. Borrowers struggling with student loan payments might forgo career goals that add meaning and purpose in order to afford higher salaries from jobs that require further education – something which could have long-term repercussions for quality of life issues.

But even if bankruptcy seems impractical, borrowers who are having difficulty meeting payments may benefit from exploring alternative solutions. Many lenders offer flexible repayment plans to help lower monthly payments; the Department of Education also offers several programs for discharging federal student loans including income driven repayment plans that enable borrowers to pay only what they can afford based on a percentage of discretionary income.

Experts advise borrowers to make payments on time to improve their credit score over time, but if this is not an option, exploring deferment or forbearance options might make payments more affordable. Finally, professional debt relief agencies may help borrowers negotiate with creditors on their behalf for debt deferment or forbearance agreements or debt reduction deals that make payments more manageable.