When determining loan interest rates, several factors will come into play. Your credit profile and lender preferences will likely have the

greatest influence. When searching for personal or mortgage loan interest rates, keep in mind that certain lenders might offer better deals depending on their goals for expanding their portfolio of loans to customers like yourself.

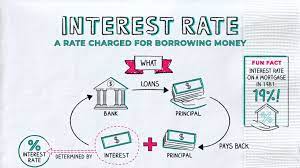

Lenders typically adjust their rates every day depending on a variety of factors, including the federal funds rate (a short-term interest rate set by the Federal Reserve), competitors’ rates and how much staff are available to underwrite new loans. They might also try to boost brand loyalty by offering certain customers lower rates if trying to increase market share.

As a general rule, lenders offer more attractive loan interest rates to borrowers with excellent or near-perfect credit scores and high incomes, who demonstrate they have successfully managed their debt and credit obligations over time – these consumers don’t pose any significant risk to lenders compared with borrowers with fair or bad credit whose previous financial performance could require higher rates for them.

Size and term length can have an enormous effect on loan interest rates; small loans with shorter payoff periods tend to attract lower rates than larger ones since lenders have less time to capitalize off your borrowing. Furthermore, your debt-to-income ratio plays a huge role in your eligibility for lower loan interest rates.

Keep in mind that interest rates on loans are just one component of their total cost to repay them; other fees could add further expenses. By keeping these in mind when comparing loan costs and selecting suitable options, you’ll be better able to compare options more accurately and select those most suited to you.

Locating the lowest loan interest rates is key to reaching your financial goals, whether that means finding a personal, mortgage, or business loan. By understanding how you can increase your chances of qualifying for lower rates and make wise borrowing decisions that will put you on a sound financial footing for years to come.

If you’re curious to find the most competitive loan interest rates, contact your preferred bank or credit union for help. A lending professional will be more than happy to discuss current offerings and tailor them specifically for your situation. Additionally, preapproval from multiple lenders before officially applying will give an idea of what offers are out there without harming your credit score – give it a try now!