The tech sector is currently enjoying its strongest rally since early Covid 2020, helping lift the broader market along the way. But where lies room for further expansion? And should investors worry that some tech stocks may have become too costly?

Hedge funds that experienced heavy losses during 2022 as technology stocks suffered sharp drops are investing more money into this sector this year, including by increasing holdings in “megacap” tech firms forming part of the so-called magnificent seven. Alphabet Inc (GOOGL.O), Amazon, Apple, Microsoft and Nvidia Inc are among the many funds investors can watch

closely by reviewing filings made to the Securities and Exchange Commission at the end of every quarter. Bill Ackman’s Pershing Square Capital Management increased its Alphabet investment nearly 100 percent to nearly 4 million shares at the end of third quarter, while Daniel Loeb’s Third Point increased Meta holdings by 41% to total 1.1 million.

These mega-cap stocks have played a key role in driving up the S&P 500 by 13% this year after experiencing a 20% slump last year, caused by sky-high inflation that forced the Federal Reserve to raise interest rates, curbing consumer spending, and sending stocks into bear market territory. Furthermore, COVID-19 pandemic resulted in business operations shifting away from office spaces towards remote and on-demand services.

Now, however, with prices falling and the Federal Reserve signaling its intent to hold off rate hikes for now, conditions have improved for technology stocks. Since many of these businesses are highly profitable and use their earnings to pay dividends or buy back shares of themselves to create long-term growth prospects.

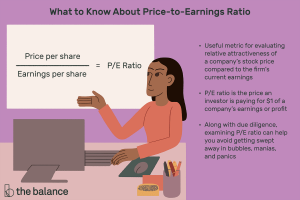

Price to earnings ratio can be an effective metric to judge the relative worth of mature technology companies that generate profits, but for younger firms who are still non-profitable revenue growth is of greater significance.

Technology giants have enjoyed robust revenue growth, as their products expand across industries and consumers shift more heavily toward digital services. Digital services’ explosive growth could provide companies with new opportunities to expand, expanding their market presence further while creating even greater demand for their products. Many investors are therefore willing to pay premium prices for some stocks associated with digital services. Not all technology companies are worthy of investment. Technology investments can be risky, so it is crucial that any opportunity be carefully evaluated prior to committing any resources or resources to it. Consulting a professional is often helpful when trying to assess if technology fits with your portfolio.